|

Life Cycle Cost Analysis (LCCA) provides an economic evaluation methodology for assessing the total cost of lifetime ownership of an asset:

The typical steps involved in a life cycle cost analysis are:

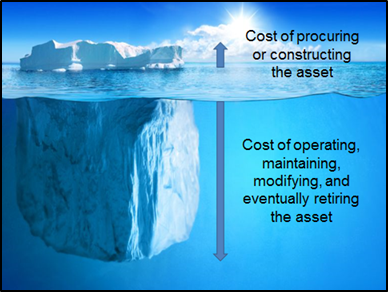

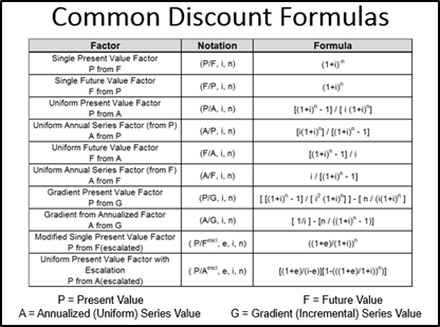

“I am not rich enough to afford cheap things” This well-known proverb is a core principle of life cycle cost analysis, which emphasizes that a lower cost of asset acquisition may not always be the best choice over the life cycle of owning and maintaining an asset. This is true whether the asset we are acquiring is a new car, or a new capital facility to manufacture cars; and is a key focus of AACE International’s Total Cost Management philosophy. LCCA is a methodology that supports an effective comparison between competing alternatives where costs (and benefits) may be spread over an extended life cycle. For the capital project industries, project teams are often focused on minimizing the capital cost of facility planning and construction through start-up of an asset; however this asset acquisition cost may be a small fraction of the total cost of ownership of the asset that also includes costs to operate, maintain, and eventually dispose of the asset. For example, an oil refinery may operate for 30 to 40 years (or more) with the costs of operation and maintenance over that life cycle exceeding the original capital construction costs by a multiple of ranging from 20 to 100. The cost of procuring or constructing an asset is just the tip of the iceberg in terms of total cost of ownership! Life cycle cost analysis provides an economic evaluation methodology for assessing the total cost of lifetime ownership of an asset; taking into account all the costs of acquiring, operating, maintaining, and eventual disposal of an asset. In order to provide an effective evaluation of costs over multiple years, LCCA relies on the concept of discounting that provides a method to convert future lump sum values, a uniform series of future values, or an incremental series of future values to a present value. The comparison of present values between potential alternatives provides a consistent methodology to evaluate the life cycle costs for alternatives that may have differing life cycles of asset acquisition and operation. Note that the concept of discounting can also be used to support a future cost evaluation (or an annual cost evaluation) between alternatives; although present value comparison is most common. The discounting conversions can also incorporate the impact of escalation when required. Discounting conversions are supported by mathematical formulas and tables, as indicated in the following table: The discount formula notation uses the (X/Y, i, n) scheme, which means find equivalent amount “X”, given amount “Y”, discount rate “i”, and the number of compounding periods “n”. When escalation is also factored into the discounting formula, it is represented by “e”. The following shows a simple investment alternative comparison evaluation: The typical steps involved in a life cycle cost analysis are:

1. Identify and define the problem requiring LCCA: This step involves identifying the potential opportunity (e.g. creation of a new asset, modification of an existing asset, retirement of an asset). Identify the potential time periods to be considered in the analysis. Identify the appropriate financial or other criteria upon which to base an eventual decision (e.g. present value versus future value, discount rate to be used in the analysis). 2. Develop potential alternatives/solutions to consider in the analysis: This step determines viable alternatives that will have economic impacts to be considered in the analysis. It may involve the consideration of capital and non-capital solutions. Often, making no change to the status quo is a potential option to be considered. 3. Develop the cost breakdown to support the analysis: The cost breakdown structure for the analysis will vary based on the particular problem under consideration and the alternatives, but at the highest level will typically include identification of acquisition costs (e.g. planning, procurement, construction) and sustaining costs (e.g. operating costs, utility costs, maintenance costs, repair costs, etc.). 4. Collect data and information to support the required cost and benefit values for each alternative: Effective analyses typically require a large amount of information to determine reasonable estimates for all elements of the cost breakdown structure. The analysis must address all elements for both acquisition and sustaining costs for each alternative; with the goal to provided sufficiently reliable unbiased estimates of both costs and benefits for each alternative. 5. Prepare the cost profiles and LCCA model for each alternative: Develop the cost profile (cost/benefit flow) over time for each alternative. Use the cost profiles to develop the LCCA model with appropriate discount formulas to support the financial analysis. The LCCA models should address all significant cost and benefit impacts (sufficiently complex but not overly complex). 6. Analyze results: Analyze the results for reasonableness. Prepare supporting analyses such as Pareto charts of key cost drivers or breakeven analyses. Test significant cost drivers with different assumptions or incorporate uncertainty analysis into the model to evaluate sensitivity for key cost/benefit drivers. Recycle to previous steps to adjust the model if warranted. 7. Communicate results and determine the course of action: Prepare reports to communicate the LCCA results to support decision making. Life cycle cost analysis is intended to measure cradle to grave costs for the asset or activity under consideration. It can be useful to identify key cost drivers to overall profitability and tradeoffs between competing alternatives. It’s a valuable technique to improve decision making be focusing on Total Cost Management, and improving long term cost effectiveness. The most effective impact from life cycle cost analysis is obtained when it is employed as a value improving practice during the early stages of project planning. It requires identification of alternatives, and good alternatives often require creation ideas. Focus on sufficient complexity to support the decision to be made. LCCA models should be flexible, traceable, and scalable; and the supporting data should be quantifiable and defensible. The techniques to perform life cycle cost analysis are not difficult; however they do require attention to detail to meet the objectives of the analysis. When performed well, they support better decision making by focusing on long-term costs and benefits to maximize capital investment performance. Comments are closed.

|

AuthorConquest Consulting Group: A Leader in Effective Implementation of Cost Engineering and Total Cost Management Archives

January 2024

Categories |

- Home

-

Services

- Cost Estimating Services

- Cost Estimate Review and Validation

- Cost Risk Analysis and Escalation Studies

- Project Readiness and Performance Reviews

- Methods and Procedures

- Software Selection and Implementation

- Cost Estimating Database Development

- Historical Database and Benchmarking

- Organizational Development

- Estimating and Cost Engineering Training

- Construction Claims and Dispute Resolution

- Cost Estimating

- Cost Engineering

- About

- Blog

- Contact

|

Copyright © 2022; All Rights Reserved

|

Conquest Consulting Group

|

RSS Feed

RSS Feed